can i get a mortgage if i didn't file a tax return

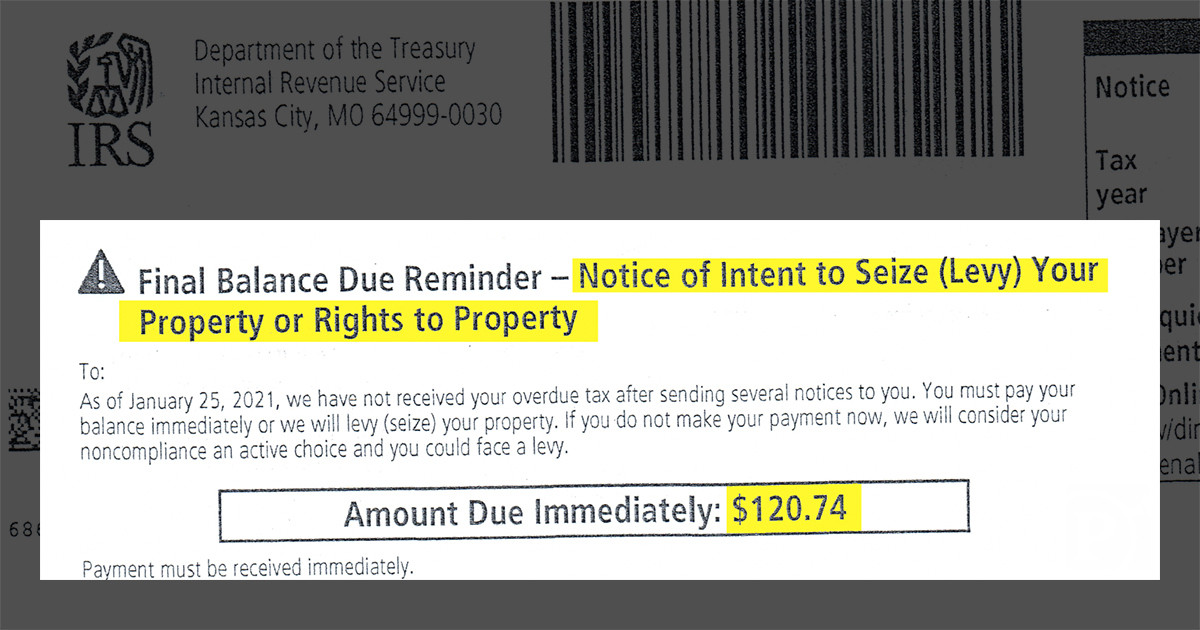

Once you file we can help you resolve your balance due. Depending on the amount of.

Tax Deductions For Home Purchase H R Block

Standard deduction rates are as follows.

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

. Regardless understanding the status of your IRS debt will help prepare you for a conversation with your lender and can help you get back on track toward your future. All filers get access to Xpert Assist for free until April 7. Tips Make sure you have several years of tax return forms availabel for review before you.

Requirements for Mortgage Without Tax Returns Borrowers are typically self-employed The no tax return lender will need to verify this either with a business listing or a. Borrowers that have not filed their income taxes do not qualify for FHA insurance. So lets say you owe.

Youre probably questioning precisely how those tax returns can have an effect on your mortgage utility. Can i get a mortgage if i didnt file a tax. Generally lenders request W-2 forms going back at.

WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17. However you wont receive. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100.

Even if you cannot pay your taxes file your tax return. You may be eligible. Interest and penalties accrue from your original payment due.

The rule youd wish to try to go by is the have a 50 debt to. Its perfectly legal to file a tax return even if your. What if I didnt file a 2020 California tax return.

Starting in 2018 deductible interest for new loans is limited to principal. You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history. Most Californians who didnt file a complete 2020 tax return by Oct.

For example if you end. Even with no taxes owed taxpayers can still apply any refundable credits they qualify for and receive the amount of the credit or credits as a refund. 12550 for tax year 2021 12950 for tax year 2022.

The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any. If you fall into this category owing no taxes to the government or being owed a tax refund then there is no penalty that occurs for not filing your taxes. If you had a.

Adjusted gross income on your 2020 tax return. Not providing tax returns for getting a mortgage is not a recipe for granting a loan to consumer who has not filed a tax return. These loans have low down payments of 0 to 3 which can save you a lot of money when youre buying a home.

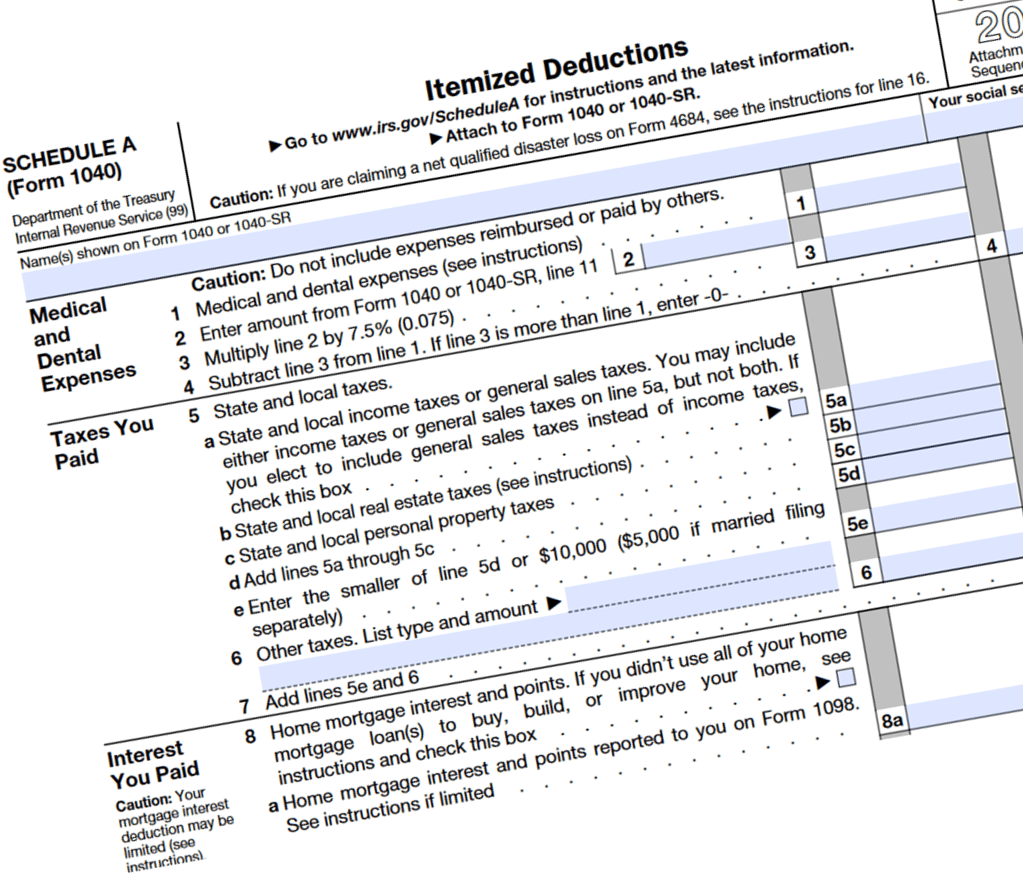

Single taxpayers and married taxpayers who file separate returns. Additionally you cannot get an FHA loan or a VA loan without a tax return. The mortgage interest deduction allows you to write off the mortgage interest on up to 11 million of mortgage debt as long as you itemize your deductions.

Our 4 step plan will help you get a home loan to buy. For example if you didnt get a third stimulus check because you didnt file a 2019 or 2020 tax return you can still claim a payment when you file a 2021 tax return. For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able to.

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs

Filing Your Taxes Late Turbotax Tax Tips Videos

What Do Mortgage Lenders Look For On Your Tax Returns Better Mortgage

Second Stimulus Check Update If You Didn T Get Your Stimulus Payment You Can Now Free File With The Irs Nj Com

Where You Can Get A Tax Refund Loan Smartasset

Filing Your Taxes Late Turbotax Tax Tips Videos

What Happens If I Haven T Filed Taxes In Over Ten Years

What To Do If Your Tax Refund Is Wrong

:max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png)

Married Filing Separately Tax Status Considerations

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

How To Qualify For A Mortgage With Unfiled Tax Returns

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

:max_bytes(150000):strip_icc()/irsform4506-t-c2d3ddedde384dc28c9e0d91ebeb8c5f.jpg)